I was beginning to get worried that the Financial Markets were slowing down, and that soon there wouldn't be much left to tax with a Financial Transactions Tax. Fear not!

The World Federation of Exchanges just published a report saying that

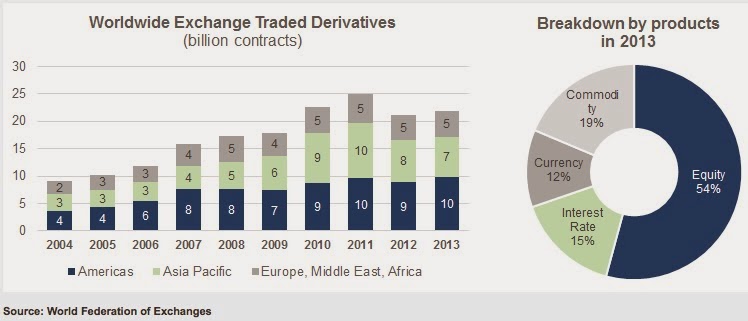

Exchage Traded Derivatives Trading Volumes recovered in 2013. Specifically, in 2013, 22 billion derivative contracts (12 billion futures and 10

billion options) were traded on exchanges worldwide – a 685 million

increase above derivatives contracts traded in 2012. Sounds like there is still plenty of trading going on.

Actually, although the WFE says that their full report won't appear till May, I had a sneak preview by downloading the detailed data files from their site which provides

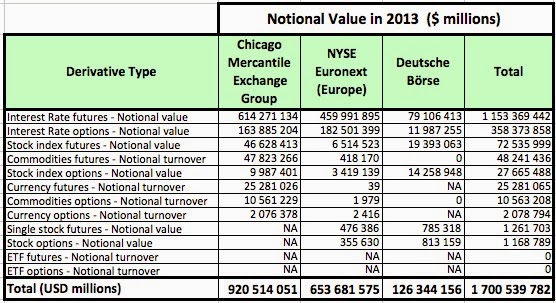

an Annual Query Tool. This provides not just the numbers of contracts traded, but also their values in millions of US dollars. Here's what I found, by adding up all the separate files.

As you can see, the total is up 17.5% on 2012, to an impressive $2010 trillion. And that's despite the fact that the 2013 figures for some important players like the Chicago Board Options Exchange (which did over $35 trillion in 2012) are currently NA - not available. The Chicago Mercantile Exchange Group, which is the biggest of them all, is up 14%. But NYSE Euronext is up 33% and the Korea Exchange increased by 42% in a year. Impressive.

To get a clearer picture of where all this activity is concentrated, I have extracted the individual numbers for the three biggest players in the next table.

You can see that between them, those three players handled an impressive $1153 trillion in Interest Rate Futures alone. Perhaps some of the people who are involved in this frantic trading would like to explain to the rest of us what benefit society gets from this? Otherwise, I would say that imposing a modest 0.1% FTT on that would be a very sensible thing to do.

Hi Simon - I have watched recently your video on youtube how with a transaction tax of e.g. 0.1% the EU could be run out of debt! You are speaking from the 2000 Trillion and 0.1% would make 2 Trillion --- but you make a thinking error - nobody will make a Swap e.g of 100 Mio Euro if you have to pay a 2x 100'000€ tax for it - so the volume of derivatives would decrease rapidly to allmost zero.

ReplyDeleteDo you realy think the financial Industry would pay about 2 Trillion if the EU GDP is only about 13 Trillion?

I like your page and tables - but don't underestimate the financial guys -they are not so stupid - unfortunately I think we can not save Europe with this kind of transacition tax you suggest.

Marcel

The Financial Transaction Tax, or Tobin Tax, is the only effective tool that governments will have to raise operating revenue going forward. Contrary to popular opinion, modern capitalism would not exist without regulation. Plus, it takes a lot of gall for corporate apologists to complain about regulation when it was their idea in the first place. That's right. The robber barons of the 1890s suggested that they be regulated, rather than have laws enacted against their harmful practices. They reasoned it was less costly to evade regulations than to break laws.

ReplyDelete